Could the United States reverse course from its position as the world’s largest importer of oil and natural gas to become an exporter of these resources? A recent report by the International Energy Agency suggests we can.

Could the United States reverse course from its position as the world’s largest importer of oil and natural gas to become an exporter of these resources? A recent report by the International Energy Agency suggests we can.

When Jennifer Miskimins MS ’00, PhD ’02 received her bachelor’s degree in petroleum engineering in 1990, the United States oil industry was still reeling from the ’80s price collapse, most major companies had shifted their exploration efforts overseas, and those remaining on shore were slowing production and focusing on the lowest-hanging fruit.

Jennifer Miskimins

Talk of an imminent ‘peak oil’ crisis was escalating. And for bright, forward-thinking engineers, job prospects were bleak.

“Nobody in their right mind was going into oil and gas at the time,” recalls Miskimins, an associate professor of petroleum engineering at Mines.

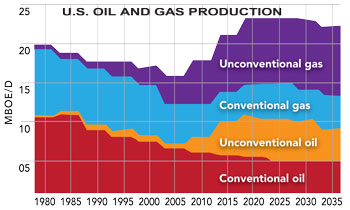

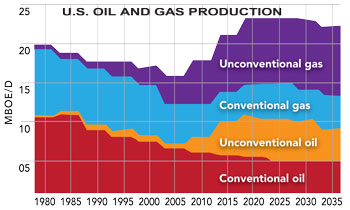

A quarter-century later, the U.S. energy landscape couldn’t look more different. According to a November report by the Paris-based International Energy Agency, ‘World Energy Outlook 2012,’ the United States is poised to be the planet’s largest oil producer by 2020, overtaking Saudi Arabia for the number one slot with a production rate of 11.1 million barrels per day. Already, domestic oil production rose more than 7 percent in 2012, marking the fourth consecutive year of increases, and the largest year-over-year spike since 1951.

Meanwhile, according to the Mines-based Potential Gas Committee, the U.S. currently possesses 1,898 trillion cubic feet of ‘technically recoverable’ natural gas (the highest assessment in the committee’s 46-year-history), a fact that recently prompted the Department of Energy to conclude that the time has come for the country to become an exporter.

As oil imports shrink and energy efficiency efforts expand, the IEA predicts that in net terms, the United States could reach energy self-sufficiency by 2035.

“North America is at the forefront of a sweeping transformation in oil and gas production that will affect all regions of the world,” states IEA’s executive director, Maria Van der Hoeven.

So how did we get here and where are we going next? The answers to both questions have a lot to do with Colorado School of Mines.

Tom Davis

“Mines has played a very significant role in this evolution,” says Tom Davis PhD ’74, a professor of geophysics at Mines. “We’ve been involved in everything from developing drilling and stimulation technologies to better understanding the geology of formations to using geophysics to look for natural fractures in the rock and find the best areas to stimulate and drill wells.”

From �easy oil� to �hard oil�

Roughly 8,000 feet below the Mines campus lies the Niobrara Formation, a dense, 80-million-year-old chunk of shale that stretches across parts of Colorado, Wyoming, Nebraska and Kansas and is believed to contain as much as 6 billion barrels of oil.

Petroleum engineers first tapped into it in 1901 at the Boulder Oil Field between Niwot and Boulder, where crude oil was found bubbling to the surface in a manner reminiscent of a Beverly Hillbillies episode, says Davis. The source of the unusual spring? An underground reservoir filled with oil that had seeped, over the millennia, from the Niobrara Formation.

In the decades that followed, as petroleum engineers tapped into this and numerous other similar pockets of oil, known as ‘conventional reservoirs,’ in Colorado and around the U.S., this ‘easy oil’ was depleted.

This EIA map from 2011 indicates the known sources of natural gas in play. Source: Energy Information Administration

Meanwhile, ‘unconventional reservoirs,’ where oil and gas are trapped in tiny pores within the rock where they were formed, remained largely untouched. “We always knew as an industry that the oil and gas were there. We just didn’t have the techniques to get to them,” says Miskimins, who specializes in hydraulic fracturing and reservoir stimulation.

With its blend of petroleum engineers, geologists, geophysicists, chemical engineers and environmental scientists, Mines stepped in early to help solve the puzzle.

“Mines was working on unconventional reservoirs before we even called them unconventional reservoirs,” quips Miskimins, noting how faculty and students have studied hydrocarbons in tight sand systems in Colorado, Wyoming and Utah for decades. “Today, there are probably 60 or 70 people working on these oil and gas issues here, and a lot of step-by-step changes are coming out of it.”

Contrary to popular belief, hydraulic fracturing is nothing new. In 1947, engineers at the Hugoton gas field in western Kansas became the first in the world to pump fluid down a well in an effort to crack the surrounding rock, boost its permeability and increase flow. By the 1980s, about 40 percent of all wells were fractured.

In the 1980s, thanks in part to drilling motor improvements and subsurface mapping technologies that came out of Mines’ horizontal drilling was adopted by the energy industry. Energy companies began drilling horizontally to reach their targets, and a handful began experimenting with fracturing rock along the horizontal wellbore.

Ultimately, the successful integration of horizontal drilling and multi-stage fracture stimulation transformed the industry, boosting the nation’s inventory of recoverable fossil energy, resources practically overnight. The Potential Gas Committee’s biennial report in 2009 reflected a 40 percent jump in ‘technically recoverable natural gas’ reserves over the 2007 report. And in 2010, proved reserves of recoverable U.S. oil and natural gas rose by the highest amounts ever recorded since the U.S. Energy Information Administration began publishing estimates in 1977.

Steve Sonnenberg

Technology changed the economics as well. Within a few years, unconventional oil resources that were previously uneconomic became spectacularly profitable. “Wells that used to produce 30 to 50 barrels of oil per day are producing 1,000 per day,” says Steve Sonnenberg PhD ’81, a professor of petroleum geology at Mines.

Contributions then and now

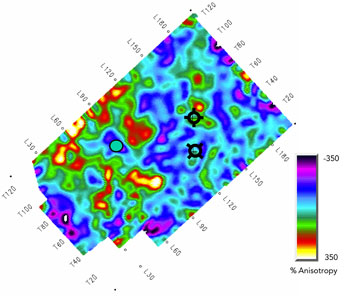

On a snowy morning in 1985, Davis and an interdisciplinary team of geologists and geophysicists began to set up equipment at Silo Field in Wyoming to record seismic waves and gain a clearer picture of what the reservoir thousands of feet below looked like. Their efforts led to the first detailed 3D map of natural subsurface fractures and faults within an oil field, and the information was used to guide the drilling of some of the earliest horizontal wells.

It was one of the first major projects undertaken by the Reservoir Characterization Project, a research consortium at Mines formed by Davis that has since emerged as an industry leader in a technique called 4D seismology, which involves taking regular 3D seismic snapshots of the same reservoir over time (the fourth dimension) and creating time-lapse video sequences of oil or gas migrating through rock as hydrocarbons are pumped out.

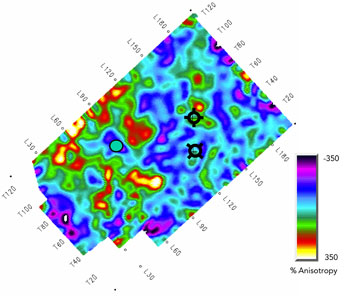

This map, by graduate student Lillian Comegys, is an example of the Reservoir Characterization Project’s work and indicates the best locations to drill, yellow being the best, purple the worst, in an area just southeast of Parshall Field, N.D. Two existing well sites are also marked.

The approach has given operators unprecedented insight into the effect of their stimulation efforts, and now, having accumulated the largest seismic dataset in the world, their models are widely used to guide drilling and stimulation efforts. “We can determine the best place to sink a well, see the effectiveness of hydraulic fracturing, and monitor the area over time to see what happens to the subsurface rock,” says Davis, noting that the approach can also help avoid induced earthquakes and water contamination, two of the biggest concerns raised by opponents of hydraulic fracturing. “We can predict and avoid areas where we have the potential to cause harm.”

Since getting her PhD at Mines in 2002, Miskimins has been working with industry colleagues, fellow researchers and students to help determine what materials work best as proppants (particles mixed into hydraulic fracturing fluids that prop open cracks in fractured rock and facilitate the flow of oil and gas) and where and how to stimulate the well for maximum efficiency. In 2003, she helped launch the Fracturing, Acidizing, Stimulation Technologies (FAST) consortium, the only university-based hydraulic fracturing consortium in the nation.

Meanwhile, Sonnenberg works with industry to make the most of the oil and gas resources in the Rocky Mountain region by directing the Niobrara Research Consortium, a collective of roughly 30 companies and a few dozen students who study everything from seismic reservoir modeling to fracturing techniques.

Azra Tutuncu

Professor Azra Tutuncu, who holds the Harry D. Campbell Distinguished Chair in Petroleum Engineering, directs the university’s Unconventional Natural Gas and Oil Institute, which launched a consortium in 2012 to support unconventional natural gas and oil exploration and development. UNGI also offers educational programs for students, policy makers and regulators.

Promise and challenges in the future

Dismissing popular environmental concerns about hydraulic fracturing as unfounded, the IEA’s report assumes uninterrupted proliferation of the technology. However, every faculty member and alum interviewed for this story concedes that the industry faces a significant public relations challenge.

“We have to assure people that this is not a technology to fear,” says Davis.

Miskimins often gives free presentations to community groups to explain the pros and cons of hydraulic fracturing, and to dispel what she sees as widespread misinformation. She explains that because the unconventional reservoirs being tapped are so far below the surface, the chance of groundwater contamination is relatively slim. She also says the amount of water used in hydraulic fracturing has been somewhat overplayed in the media.

“But if public perception is that it is a bad thing to be using all this water, then industry needs to be looking for other options,” she says.

Yu Shu Wu

In August, Mines professor Yu-Shu Wu, Miskimins, and Xiaolong Yin (an assistant professor at Mines) were awarded a $4.66 million grant, funded jointly by the Department of Energy and the petroleum industry, to explore using rapid cooling to fracture rock instead of water.

“The idea is to use liquid nitrogen, which is very cold, to generate fractures,” explains Wu. “After a couple of hours, when the temperature warms back up, it evaporates.” That reduces the risk of contaminating groundwater and of damaging the formation itself, which lingering water from hydraulic fracturing can do. “It’s really early days, but if it works, it could change the industry,” says Wu.

Along similar lines, Wu, Davis and dozens of other Mines faculty and students are exploring ways to use CO2 emitted from coal-fired power plants as a fracturing fluid. In addition to addressing water use concerns, the CO2 would largely remain sequestered in the subsurface rather than going into the atmosphere.

Carolyn Koh

On the natural gas front, one area that scientists at Mines’ Center for Hydrate Research are pursuing is how fuel might one day be transported in crystalline hydrate form. Currently, natural gas is transported by ship as a liquid that must be kept at a frigid 260F. If systems could be developed to efficiently create natural gas hydrate, which remains stable at a balmy 4F, the energy savings could be considerable. The trade-off is that the hydrate is much less dense than liquified natural gas. “The key is making these hydrate crystals in a way that is very efficient,” says Carolyn Koh, a professor at Mines and co-director of the center. “It involves fundamental science with important applications.”

In the end, faculty members say, the greatest contribution the school has made to the energy industry is to turn out graduates with a broad-based interdisciplinary understanding of oil and gas, which they apply to everything from exploration to policy making.

For those graduating today, the future looks bright. “We are unique, and that is recognized by industry,” says Sonnenberg. “One hundred percent of the students coming out of our programs are getting hired right now.”

Editor�s Note: In this article we did not have the space to discuss natural gas hydrates as a natural resource. In fact, as we discussed in this article several years ago, vast reserves of natural gas are found in and around North America, both under the ocean and in Arctic permafrost. While the current price of natural gas makes commercial development of the resource less attractive in the U.S., in Japan, where the price is more than four times higher, there is a much greater incentives. Japan�s efforts are discussed in this MIT Technology Review article, in which Prof. Carolyn Koh is quoted.

Could the United States reverse course from its position as the world’s largest importer of oil and natural gas to become an exporter of these resources? A recent report by the International Energy Agency suggests we can.

Could the United States reverse course from its position as the world’s largest importer of oil and natural gas to become an exporter of these resources? A recent report by the International Energy Agency suggests we can.

In the case of dry gas the amount of gas produced is exceeding, or at least approaching ridiculously high recovery efficiencies in several cases. It seems the model of free gas (from natural gas tables) + adsorbed gas (from Langmuir isotherm taken on core) may very well be an underestimate of gas in place.

The only obstacle to the United States becoming self sufficient is the government. The United States is the only government in the world that does not actively help strengthen its energy companies. In fact the US government actively suppresses its energy companies.

There are two reasons for everything the government does. There is a very good reason, the rational they give you for doing it, and the real reason.

The rational for suppressing the energy companies and projects like the Keystone pipeline are environmental concerns. The goal of environmentalists is to eliminate the use of hydrocarbons completely. This will never happen outside of the United States. The United States produces and uses hydrocarbons more cleanly than any other nation. So environmentalists are only shifting the development of hydrocarbons to nations with poor environmental practices.

The real reason for suppressing the energy companies in the US is to get campaign contributions to get re-elected. Much of these contributions come from countries we import energy from. The rest comes from environmental lobby groups that are also heavily funded by countries we import energy from.

For example, we subsidize ethanol to get electoral votes. Yet ethanol increases fuel consumption by making our cars run less efficiently. One government report demonstrates that ethanol treated gas is only 69% as efficient as straight gasoline. In my own tests I find I get at least 25% more mileage when I burn pure gasoline. So we are actually consuming more oil and polluting more by diluting our gas with ethanol. Worse yet we make our ethanol from corn instead of switch grass or sugar cane. We will soon run out of water as a result. It does not make economic sense, it is only done to bribe farmers for their electoral votes.

Ideally, we would switch our cars from gasoline to natural gas. We would bury our nuclear power plants deep in our granite shields and produce all of our electricity safely and cleanly. We could dispose of our nuclear waste in deep wells drilled beneath the reactors. Then we could export our coal.

The only reason we are not energy self sufficient right now is because the best government that foreign money can buy is standing in the way.

Correction: When talking about campaign contributions I said some comes from foreign interests and “the rest comes from environmental lobby groups”. Obviously not all campaign money comes from only those two sources. The point I want to make is foreign interests are funneling a lot of money into lobby groups and politicians to persuade our government to suppress our own energy companies. Those same foreign interests are doing everything they can to cultivate and grow their own energy companies. This is one of the problems of having the best government that special interest money can buy.

Steve Sonnenberg:

Do the reserve estimates used by the IEA to assert energy independence for the US, actually match up with observed long-term behavior of the shale wells? There is no doubt in my mind that the small to mid-sized independents in the shale plays are doing their utmost to publicize the more impressive IP’s in their portfolio’s, in order to justify higher stock prices, and fund ever more expensive leases and capital costs. Collectively they have done an excellent job of creating a feeding frenzy of activity and investment over the last three our four years.

However, I have seen little in the way of credible EUR estimation that supports the assertions made by the IEA. In fact what I have seen are one or two studies that show the majority of wells decline rapidly and are at best marginally economic over the long-term. For those of us that grew up the the scientific community of Mines, is it true that we all “missed” the true potential of shales, or are we in an internet bubble of sorts?

Steve,

Some of the longest producing oil wells are producing from shale. There are wells in Penrose Colorado that have been producing for around 100 years or so. True they decline very rapidly, however, they will likely continue to produce at low levels for a long time.

Large corporations may not be able to afford to produce the wells after productivity drops. But they can sell them to small independents who can easily profit from wells producing only 2 barrels a day.

You may be right. Shale oil and gas production may “peak” faster than conventional methods, but it will still be a long term supplement to our energy supply. And if we switch our cars to compressed natural gas we could certainly become energy self sufficient for a long time.

Also, we are not the only country with oil shales. The rest of the world will soon catch on and this will drive down the price we will have to pay for any imported oil.