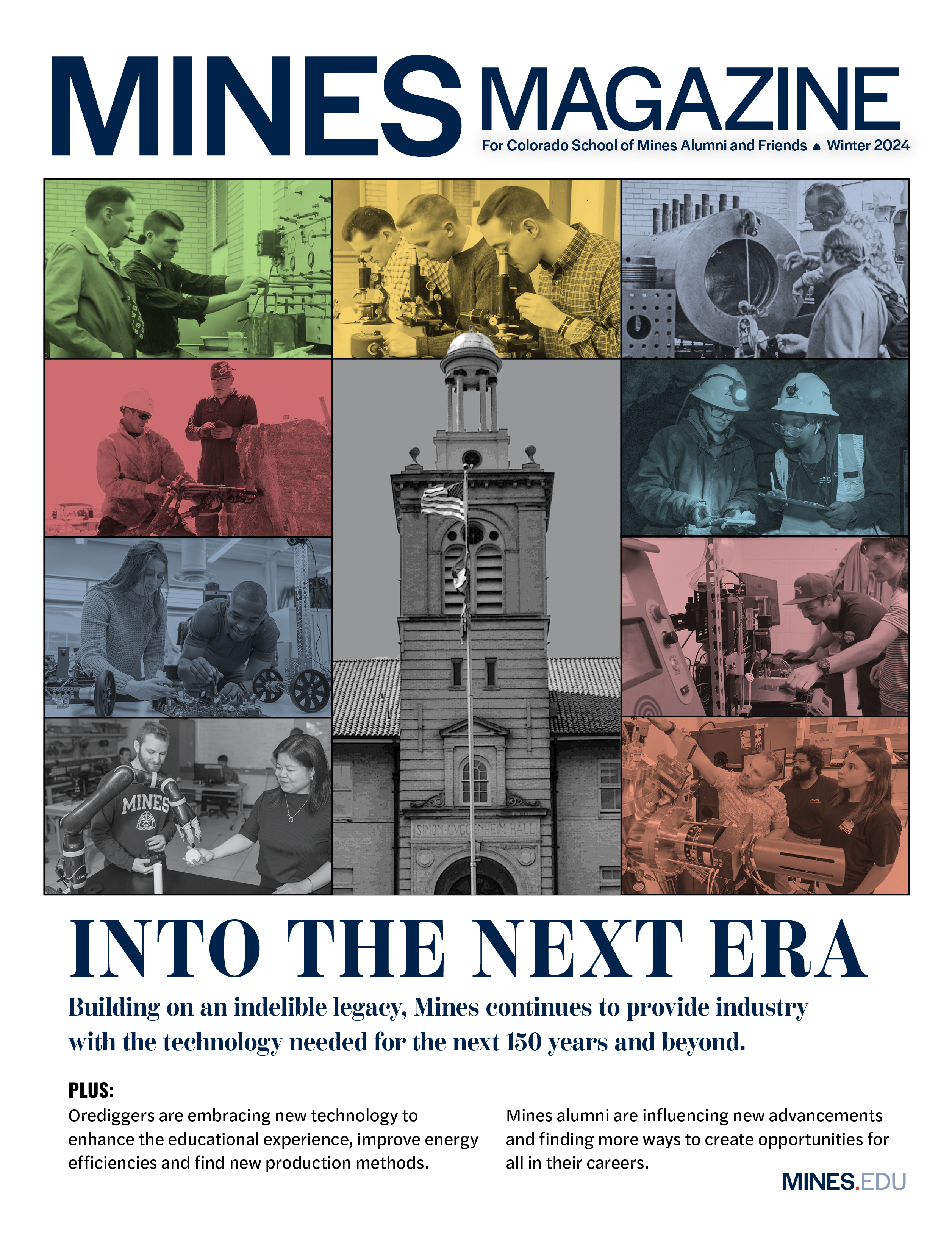

Trillions of cubic feet of natural gas and billions of barrels of oil are now economically recoverable, thanks to advances in hydraulic fracturing technologies, and more enhancements might soon be on the way.

Will Fleckenstein is combining existing technologies to create a new process that he expects will increase the productivity of natural gas wells.

Will Fleckenstein ’86, ME ’88, PhD ’00, an adjunct professor in the Petroleum Engineering Department, is collaborating with the school and entrepreneurs at the Boulder Innovation Center to establish the private company FracOptimal, which will hold an exclusive license to the new technology and take it to market. “We’re in the midst of arranging testing and field trials,” says Fleckenstein, who has 26 years in the field. “We’ll probably have something in the ground in about six months.”

Most oil and gas wells drilled in the U.S. today are hydraulically fractured to enhance recovery. The procedure is complex, time consuming and very expensive: A single vertical well is bored down to the hydrocarbon-bearing rock, sometimes as deep as 14,000 feet, before continuing horizontally through the gas- or oil-bearing shale for up to 10,000 feet. Rock surrounding the horizontal portion is fractured in sections, called stages, by sealing off that portion of the borehole and pumping frac fluid (generally a mixture of water, sand and a small quantity of chemicals) at extremely high pressure into the surrounding rock. The idea is to create a network of fractures for the hydrocarbon to escape into the perforated well casing, and then to the surface.

Among other factors, productivity of a completed well is determined by how far a well-developed system of fractures extends from the horizontal borehole, which is primarily a factor of pressure, more pressure results in a larger fracture system. But to keep pressures high, stages must be kept short, and therein lies the problem.

Using current technologies, there’s a limit to the number of stages that can be incorporated into a horizontal borehole, the cap is generally about 40. One of the most popular technologies employs sets of balls of different sizes to isolate each stage. As each stage is completed, another ball, one size larger than the last, is injected into the well. When it lodges in a targeted casing, pressure builds up, sliding a sleeve down the casing to reveal openings in the steel. Pressurized frac fluids pass through the openings and into the surrounding shale, fracturing the rock. It’s an efficient system, but the number of stages that can be fractured in any single well is limited by the number of ball and sleeve sizes possible. In addition, balls are often not retrieved, which can limit the well’s subsequent productivity.

With patent applications still in process, FracOptimal isn’t providing too many details on the technology, but Fleckenstein says they have developed a system that can pack in as many stages as an operator wishes using just the largest ball size. What he isn’t detailing is how the apertures, through which balls must pass to reach the targeted casing, are controlled. The one hint he gives: It’s a straightforward design, based on existing technology.

“Simplicity is the key to a successful technology when you are working at these depths. Everything has to work every time,” he says.

In addition to packing in more stages, another advantage is that the casings don’t get smaller downhole, so fluid pressure isn’t reduced, and every stage can be fractured with equal pressure. In addition, each ball’s location can be sensed from the surface and its movement directed.

What difference does it make? Fleckenstein says even if it’s just a few percentage points, it’s worthwhile. About two-thirds of new U.S. wells are horizontal and access less than 10 percent of available hydrocarbons in shale plays. “If you’re able to increase the productivity of one of these wells by 20 to 50 percent, it has tremendous monetary value,” he says. In North Dakota’s vast Bakken Field, just 10 percent greater productivity would amount to 50 billion barrels, double the oil recovered from Prudhoe Bay in Alaska.

FracOptimal is exploring several manufacturing and distribution possibilities, including partnering with large service companies that pump fracturing fluids, says Fleckenstein. Adding a technology that can pack in more stages would make all their services more valuable, he says.